When it comes to taking a stance on the future direction of the gold markets, investing or trading are two distinct options.

In order to profit from a gold investment, you must first acquire possession of the asset and then watch the price of the precious metal climb. Rather than owning the item itself, when you buy gold, you are taking a stance on whether the underlying price will rise or decline in the future..

According to whether you are concerned about the physical property or otherwise, there are various different types of golden assets accessible for you all to trade and/or invest in. Examples of such items are:

Bullion In Gold

For both private investors and financial institutions, gold bullion – in a form or coins & bars – is a popular store of value. Nevertheless, the high cost of safekeeping and insurance frequently discourages more market participants from purchasing the metal outright.

Place Gold At Strategic Locations

Spot gold prices are the prices at which gold may be purchased immediately – or even on the spot – without having to wait. It is commonly expressed in terms of the price with one ounce of gold of platinum. A common way to gain exposure to gold bullion without needing to acquire physical possession of the bullion is to trade in spot gold.

Futures On Gold

In order to transfer gold for a predetermined price at a specific date in the future, futures contracts must be executed. The responsibility to uphold your half of the bargain would fall on you, whether it was through a bodily or a monetary payment. In terms of quantity and quality, futures are standardised — the only thing that varies is their price, which is dictated by market forces

Investing In Gold

Futures and options contracts operate in a similar manner, with the exception that there is no obligation to complete the trade when purchasing an option or contract. You can use options to exchange physical gold or futures contracts for physical gold at a certain price and on a specified date. Option contracts for precious metals provide their holders the right to purchase the metal, whereas option contracts for precious metals allow their holders the option to sell the metal.

ETFs Invested In Gold

Gold mining, refinery, and production businesses that are publically traded in the market exchange are included in a basket of ETFs. ETFs are a terrific method to diversify your portfolio because they provide you a lot more exposure than a single stock does. Instead of attempting to outperform the market, digitally traded funds are passive assets that aim to match the market’s results.

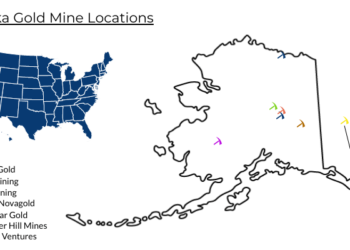

Stocks Of Gold

Investing in or trading on equities can be a terrific method to gain to some to gold. You will get the opportunity to learn about every aspect of the jewelry industry, from mining & production through funding and distribution. There are a variety of additional factors that influence the price of gold stocks, and it is important to remember that they do not always follow the same path as gold bullion.