Gold, along with crude oil, is one of the most commonly traded raw resources in the world and unquestionably the most popular precious metal due to its monetary as well as cultural significance.

Gold’s Worth

Political, social, and economic instability can affect the price of gold. It is common for traders to refer to the gold market as a “safe haven” due to the fact that unlike some stock market investments, the price of gold is not necessarily subject to changes in government policy or inflationary effects from interest rates. In times of uncertainty, investors may choose to reallocate their assets to the gold market, making it a kind of insurance. It is possible that gold’s value could climb due to the fact that traders are looking to utilise this as a stock hedging.

Depending on the state of the economy, gold as well as other precious metals may have a negative association with equities and bonds. Precious metals have long been considered safe havens for traders. Gold trading is an option for some traders when their stock investments are losing value, and they want to offset their losses. In the price of gold, this is called as hedging, and it is a common trading strategy. Investors diversify their investments by placing bets on a variety of markets where the gold price may rise in response to circumstances that would normally lower the price of equities and bonds.

Online Gold Trading

As a gold dealer, you have a wide range of possibilities to choose from. It’s simple to resell gold on the open market. Gold’s spot price indicates the current price at which a buyer can buy or sell the commodity for immediate delivery. Alternatively, you can trade gold using a forward agreement, that is an agreement to resell a specified price at a later period. Read on to learn more about forward trading.

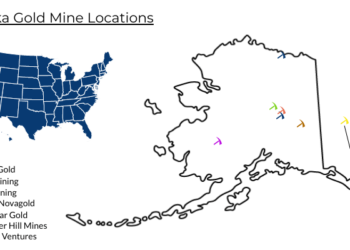

There are other popular choices like betting and CFD trading, which both provide access to a variety of markets, notably commodity trading. Our instrument page in Gold – Cash shows our attractive spread, resell prices and borrowing rates, and the typical trading hours for gold trading. A new Usa Gold share basket is also available to trade via spread bets or Cfd, which monitors the top 15 gold sector equities. It is estimated to be worth roughly $20 million and includes Newmont, Barrick, and Franco-Nevada gold stocks.

Investing In Gold Spreads

Our most popular gold trading product is this one. Without owning an actual piece of gold, you can trade income while taking benefit of its fluctuating price. Using spread betting, you can speculate on whether the gold price will climb or fall, and then open an investment position accordingly. If the market turns in your favour, you’ll profit. If it doesn’t, you’ll lose money.

CFDs On Gold

It is possible to trade gold CFDs (contracts for difference) by depositing only a tiny fraction of the total trade value, known as margin. You don’t own the gold, but you agree to trade the difference in price from the time change between closure the position (similar to spread betting).